The property tax reform approved in Law 66 of 2017 will enter into force on the 1st of January 2019. It establishes new rates for the payment of real estate taxes. General taxes will remain the same ~ These new fees apply to family or personal residences only. To receive the new benefit, taxpayers must submit an application to the Directorate General of Revenue (DGI – Dirección General de Ingresos) to declare the property as family property.

1. Who has the right to request it? The benefit applies to the principal residence of a family or person, both national and foreign, regardless of their marital status (single, joint, married, widowed …).

The decree distinguishes between the tax on family property and main residence, although in both cases there is the exoneration of the first $120,000 and the most advantageous rates will be received. The family tax estate is mainly for married couples, with or without children, or single parents. In the case of a couple of spouses who live permanently in the same home, they can only include a residence as a family property.

2. How is it requested? Through a form (an affidavit) that the DGI will create and to which the documents proving that the person or company owns the property will be attached.

Decree 363 details the necessary documents in each case. For example, a natural person married without children must attach a marriage certificate, a copy of the identity card or passport of the owner and a simple copy of the public deed with the generals of the property (name, identity card, address) updated. Spouses with minor children must also present the birth certificate of the children. Also included in the decree are the necessary documents that must be presented when the property is in the name of a company, a trust or a private interest foundation.

3. When should the application be submitted? The regulation enters into force in January 2019, but the DGI can receive them from the promulgation of Decree 363, beginning on December 4. Since the first property tax payment is made in April, it is not necessary that the application has been entered before the end of the year. The rule establishes “positive administrative silence”, that is, if there is no response from the authority in three months, it will be understood that the property is a family property or main residence. However, if the DGI later realizes that the request is fraudulent, it may revoke the status of the farm.

4. I live in a property and I have a tax exemption, what happens? The asset will continue to enjoy the exemption until its end on the improvements and then will be taxed at a rate of up to 1%, corresponding to the value of the estate.

If the owner decides to establish it as a tax family property or main house, he will lose the remaining years of exoneration and will begin to pay with the table that exempts the first $120,000 from the payment. This is the same for a single family residence. If you already have a tax exemption, the new rates go into effect after that exemption expires.

6. Do I have to update the property value of my property to request the benefit? It is not required to declare the property as a family property or main residence, but the authorities recommend verifying that the value that appears in the DGI is the same as in the National Authority of Land Administration (Anati) and is the highest value that has been registered in the Public Registry for any transfer that may have been subject to such property in your transfer history (purchase, donations, auctions, etc.) to ensure that the tax paid corresponds to the highest cadastral value that the property has acquired, since that greater value is the real tax base that generates the real estate tax and that is what the Anati must have registered.

6. Do I have to update the property value of my property to request the benefit? It is not required to declare the property as a family property or main residence, but the authorities recommend verifying that the value that appears in the DGI is the same as in the National Authority of Land Administration (Anati) and is the highest value that has been registered in the Public Registry for any transfer that may have been subject to such property in your transfer history (purchase, donations, auctions, etc.) to ensure that the tax paid corresponds to the highest cadastral value that the property has acquired, since that greater value is the real tax base that generates the real estate tax and that is what the Anati must have registered.

7. What is the NEW property tax rate that applies to the main dwelling or family estate?

* The first $ 120,0000 will be exempted.

* Between $120,000 and $700,000 will pay 0.5%

* Over $700,000 will pay 0.7%.

For example, a home that is registered with a value of $ 150,000 will have the first $120,000 exonerated and will pay 0.5% on the remaining $30,000 In that case, the taxpayer must pay $150 per year.

8. What if I do not apply to register my property as an estate or primary residence? The general rates will apply.

- No property tax on the first $30,000

- Between $ 30,000 and $250,000 will pay 0.6%

- Between $250,000 and $ 500,000 will pay 0.8%

- Over $500,000 will be taxed 1%.

The taxpayer will pay for the current taxes directly to the DGI.

Do you have more questions? The DGI serves the public via phone on 524-1600 from 8:30 am to 4:30 pm. You can also check the web page dgi.mef.gob.pa , or send your queries to the following address: consultsetax2@mef.gob.pa.

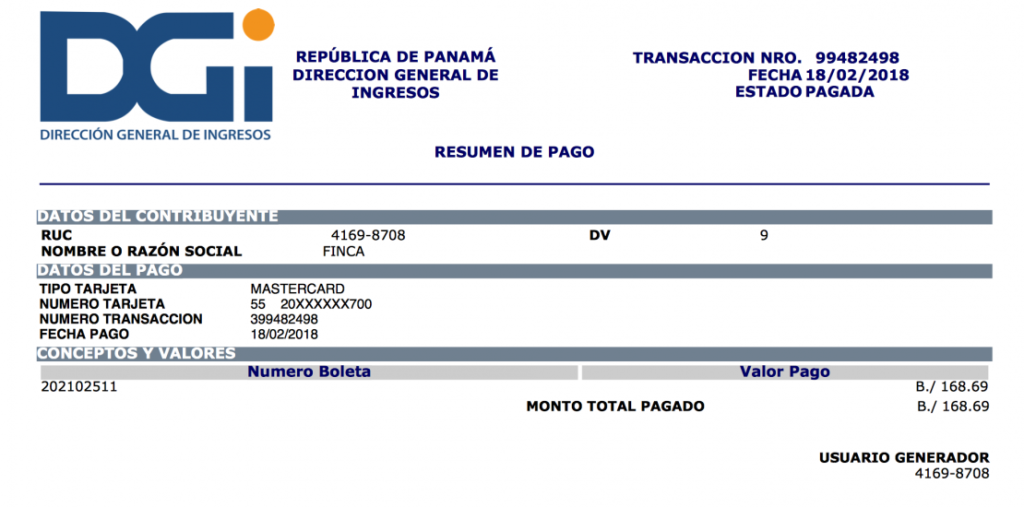

You can make Property Tax Payments online, using a Credit or Debit Card.

_______________________________________________________________________________

At the moment it is possible to make payments only through Visa and Mastercard’s credit cards. The procedure is the following:

1. One must access with the RUC and NIT through the DGI website dgi.mef.gob.pa

2. Select:Recaudación Bancaria

3. Select: Generar Boleta a partir de CCC

4. Choose the option: Tributos o Arreglo de Pago o Tributos por período

5. Generate Slip /Generar Boleta.

Once the slip is generated you must choose the option “Pay”

Fill in credit card information and make the payment. You can also make payments with debit and credit cards in person at the offices of the DGI nationwide.

If you need assistance with the registration of your NIT and further payments, do not hesitate to contact us at: info@primesls.com